Table of Contents

PMEGP online application 2022 last date|pmegp subsidy|pmegp loan interest rate|pmegp subsidy scheme|pmegp subsidy claim online

PMEGP is the abbreviation of prime minister Employment generation program.In the recent past, the ministry of micro, small and medium enterprises implemented this central government welfare scheme.The Central government officials have fixed the loans ranging from rupees 10 to rupees 25 lakh for unemployed people of the country so that they can start their own employment shortly.As we all know that, the khadi and village industries commission (KVIC), implemented this prime minister Employment generation programme scheme as the nodal agency at the national level.

Under the scheme, KVIC routed the Government subsidy via the identified banks.The beneficiaries will get the amount from their bank accounts. The concerned officials distribute the amount eventually to the beneficiaries’ bank account.The prime Minister Employment generation program is also known as subsidiary program that was implemented in 2008.It was under two earlier schemes like Prime Minister Rozgar Yojana and Rural Employment generation program.The project approval has been increasing 44% during the first five months of the financial year 2020-21 under the prime Minister Employment generation program.

PMEGP Loan Scheme 2022

All candidates wish to apply online then download the official notification carefully. As an applicant, you need to read all eligibility criteria and application process respectively.We have shared brief information about the Prime Minister Employment generation program 2020 such as key benefits, eligibility criteria, key features,application status, and application processes.

PMEGP Scheme

| Name of the scheme | PMEGP Loan Scheme 2022 |

| Launched by | CM Mamta Banerjee |

| Objective of the scheme- | loan for Employment. |

| Post category-. | Scheme/Yojana |

| Scheme Benefit- | providing assistance to the vulnerable section of the population. |

| Official portal-. | www.kviconline.gov.in |

Objectives of PMEGP

The PMEGP project operates with the following four objectives.

- Set up micro-enterprises and self-employment projects in both rural and urban areas, thereby creating more employment opportunities.

- To provide opportunities for ethnic craftsmen or artisans and unemployed youth in order to create self-employment avenues.

- Provide sustainable employment, especially for ethnic artisans to prevent rural youth from moving to urban areas searching for work, and to ensure employment throughout the year for seasonally employed people.

- Increase the growth rate of employment in urban and rural areas by increasing individual earning capacity

PMEGP Loan Scheme 2022 Eligibility criteria:-

- Applicants age should not be less than 18 years.

- New projects are mandatory for sanction of loans.

- Production cooperative societies and charitable trust organizations will be eligible to apply.

- Self-help groups that have not taken any benefits under any other public scheme, societies, production cooperative societies and charitable trust.

- The Beneficiary individual should be at least 8th standard pass to set up for the various projects.

- What is the PMEGP loan interest rate?

- Under the PMEGP scheme, the regular interest rate can be 11-12%.

Essential documents to apply online:-

- Aadhar card

- PAN card

- Caste certificate

- Domicile certificate

- Educational certificate

- Mobile number

- Recent Passport size photograph.

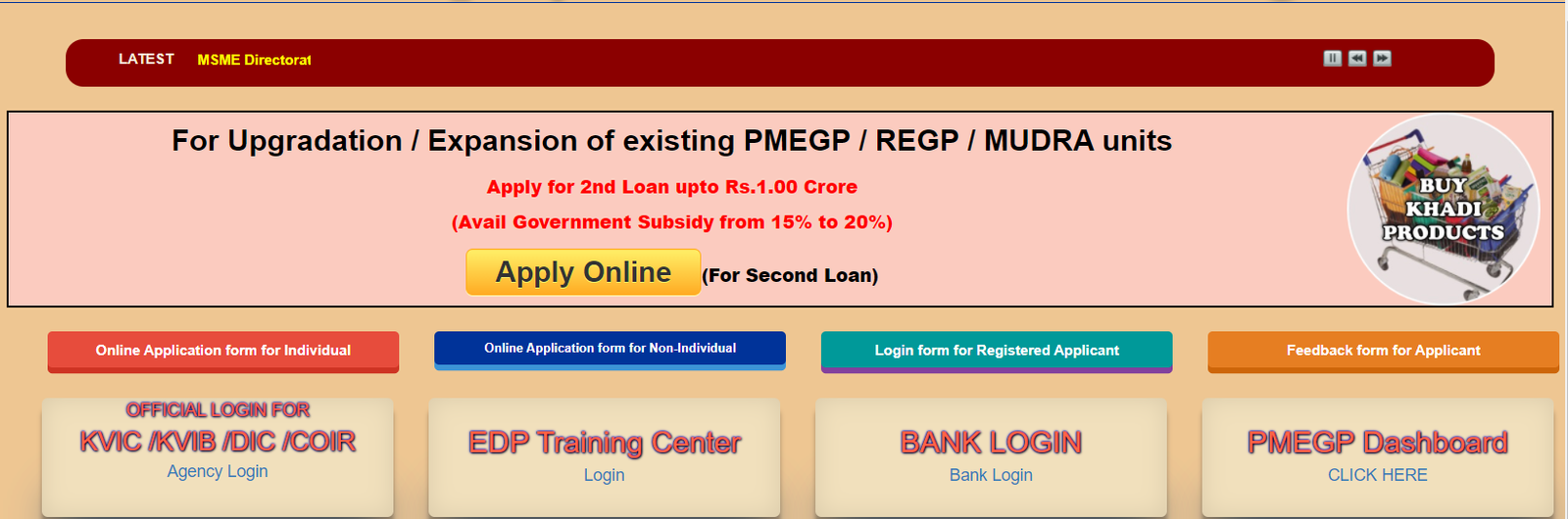

Application procedure for PMEGP scheme 2022:-

- You can go to the official website of the prime minister Employment generation program.

- Then, you can tap on the PMEGP option button.

- After that, you can see the PMEGP e portal option on the home page.

- Then, you will have to hit on the online application form of an individual option.

- After that, you will see an application page in front of you on the screen device.

- You can enter the relevant details like name, sponsoring agency, type of activity, fast financing bank and so on.

- After filling the form, you can tap on save applicant data.

- You will upload documents for final submission of application.

- Then, you can hit on the submit button.

- Finally, an application ID and password will be provided to your registered mobile number.

Application procedure for non-individual:-

- You will have to go to the official website of the prime minister Employment generation program.

- On the landing page of the web portal, tap on the option PMEGP option button.

- Then, you will watch the option PMEGP e portal.

- On the other hand, you will have to hit on the link for the online application form for non- individual.

- Now, you can choose according to your category.

- After that, you will enter various details like name, sponsoring agency, type of activity, first financing bank and so on.

- Then, you will hit on the save applicant data.

- After this, you can upload all relevant details of documents.

- Now, you can hit on the submit button for the final submission of the application.

- Finally your application process will be completed accordingly.

FAQs on PMEGP Loan

Q. What is PMEGP Full Form ?

Ans. PMEGP stands for Prime Ministers Employment Generation Programme (PMEGP).

Q. What is the maximum project cost allowed under PMEGP?

Ans. The maximum loan limit for a project is Rs. 25 lakh for manufacturing unit and Rs. 10 lakh for service unit.

Q. Is collateral required for a loan under PMEGP?

Ans. There is no collateral required for projects costing up to Rs. 10 lakh under the PMEGP scheme. The CGTMSE provides a collateral guarantee for the project beyond Rs. 5 lakh and upto Rs. 25 lakh under the PMEGP scheme.

Q. What is the Age limit to apply for a loan under PMEGP?

Ans. The minimum age to apply for a loan under PMEGP is 18 years and above.

Who can apply for a PMEGP loan?

Ans. Applicants who are minimum 18 years of age and have passed VIII standard can apply for loan under PMEGP scheme. Additional entities that can apply for loan under PMEGP include Self-help Groups, Charitable Trusts, Societies registered under Societies Registration Act, 1860 and Production Co-operative Societies.

Q. How long does it take to get a PMEGP loan?

Ans. After the training programme is completed which is of around 16 days, the approximate time duration to avail loan under PMEGP from banks require 2 months in total.

![[Eligibility] Indian Army Agneepath Scheme Apply Online Indian Army Agneepath Scheme](https://www.hindischeme.in/wp-content/uploads/2022/06/Screenshot-2022-06-15-125939-150x150.png)